Flood Insurance

Flood insurance

Flood insurance is highly recommended. Remember, even if the last storm or flood missed you and even if your home has been floodproofed, the next flood could be worse. Most homeowners insurance policies do not cover property for flood damage. South Holland participates in the National Flood Insurance Program. Local insurance agents can sell a flood insurance policy under rules and rates set by the Federal government. Any agent can sell a policy and all agents must charge the same rates.

Any house can be covered by a flood insurance policy. It does not matter if it is in the mapped floodplain or out of it. Detached garages and accessory buildings are covered under the policy for the lot’s main building. Separate coverage can be obtained for the building’s structure and for its contents (except for money, valuable papers, and the like). The structure generally includes everything that stays with a house when it is sold, including the furnace, cabinets, built in appliances, and wall-to-wall carpeting.

|

|

There is no coverage for things outside the house, like the driveway and landscaping. Renters can buy contents coverage, even if the owner does not buy structural coverage on the building.

Some people have purchased flood insurance because it was required by the bank when they got a mortgage or home improvement loan. If you have a policy, check it closely. You may only have structural coverage (because that’s all that banks require). During the kind of flooding that happens in South Holland, there may be more damage to the furniture and contents than there is to the structure.

Basements, split levels and bilevels: There is limited coverage for basements and the below grade floors of bilevels and trilevels. The National Flood Insurance Program defines “basement” as “any area of the building, including any sunken room or sunken portion of a room, having its floor below ground level (subgrade) on all sides.” This includes split levels and bilevels.

Coverage under building or structural coverage is limited to specific items needed for the operation of the building, such as a furnace, water heater, clothes washer and dryer. There is very limited coverage for finishings, such as wallpaper and carpeting, and contents. Flood insurance only covers damage when there is a general condition of surface flooding in the area.

Preferred risk: The National Flood Insurance Program has a special “preferred risk policy” for properties outside the mapped floodplain with no previous flood insurance claims. It’s cheaper and is designed to provide “peace of mind” to owners of homes subject to a lower flood risk. For more information on this type of policy, click here.

Elevation Certificates

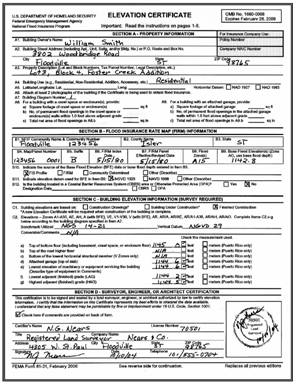

If your property is in Special Flood Hazard Area, i.e., the area shown on the Floodplain Map, and you want to buy a flood insurance policy, you may need to give the insurance agent a FEMA Elevation Certificate. This form is completed by a surveyor and it shows all the data needed to write a policy, such as the elevation of the base flood and the elevation of the house’s lowest floor.

Under the Village’s Floodplain Rules, a completed Elevation Certificate is also needed as a condition of constructing a new house or a substantial improvement to an existing building.

The Village’s Planning and Development Department (210-2915) has some Elevation Certificates on file from earlier construction permits. If you have a property in the regulatory floodplain shown on the Floodplain Map, check with the Department before you pay for a new survey.

Filing a Flood Insurance Claim

Step 1. Contact your agent to report your loss:

Have ready the name of your insurance company (your agent may write policies for more than one company), policy number and a phone number and/or e-mail address where you can be reached. If you get in touch with your agent or company representative directly, they will advise you how to file your notice of claim. Otherwise, you must send a written notice to your insurance company with your policy number.

Step 2. Separate your property:

Your policy requires you to separate damaged property from undamaged property. But don’t throw anything away before an adjuster has seen it. If local officials require damaged items to be thrown out, take photos before disposing of them and keep samples for the adjuster to see (for example, cut out a piece of wall-to-wall carpet). Do all you can to protect undamaged property.

Step 3. Make a list of damaged contents:

If you have contents coverage, make a list of damaged property. List the quantity of each item, a description, brand name, where purchased, its cost, model and serial number (if appropriate) and your estimate of the loss amount. Attach your bills, receipts, photos and any other documents.

Step 4. List areas of structural damage:

As you look over your property, make a list of any areas of structural damage you want to point out to the adjuster. If you have damage estimates prepared by one or more contractors, provide them to the adjuster since they will be considered in the preparation of your repair estimate.

See also FEMA’s website for more information: Click here

When the adjuster comes:

Generally, your adjuster will contact you within 48 hours after receiving your notice of loss. However, depending on local conditions and the severity of flooding, it may take more time. Once the adjuster reaches you, a time will be set for the adjuster to view your property.

During the visit to your property, the adjuster will take measurements and photographs and note the flood damage. This is called “scoping” a loss. Your adjuster will be an experienced claims professional and will notice many points of damage you could overlook. However, you are encouraged to point out all damage you have noticed.

The adjuster uses the knowledge gained from the visit(s) − and the documentation you provided − to complete a detailed estimate of damage. You will get a copy. You may ask the adjuster for an advance or partial payment. If you have a mortgage, your mortgage company will need to sign the building property advance check.

Your official claim for damage is called a Proof of Loss. It includes a detailed estimate to replace or repair the damaged property. It must be fully completed, signed, and in the hands of your insurance company within 60 days after the loss occurs. In most cases, the adjuster, as a courtesy, will provide you with a suggested Proof of Loss. However, you are responsible for making sure that it is complete, accurate and filed in a timely manner. Be sure to keep a copy of the Proof of Loss and all supporting documents for your records.

Sewer backup insurance

Several insurance companies have sump pump failure or sewer backup coverage that can be added to a homeowner’s insurance policy. Each company has different amounts of coverage, exclusions, deductibles, and arrangements. Most are riders that cost extra. Most exclude damage from surface flooding that would be covered by a National Flood Insurance policy. Check with your property insurance agent for more information.

Don’t wait for the next flood to buy insurance protection.

Don’t wait for the next flood to buy insurance protection.